Welcome to the world of Ichimoku Cloud trading, where the art of technical analysis meets the power of cloud-based indicators. In this guide, we will delve deep into the workings of the Ichimoku Cloud and explore how it can help you enhance your trading strategies. Whether you are a seasoned trader or a novice looking to boost your trading game, this article will equip you with the knowledge and skills to trade with confidence.

What is the Ichimoku Cloud?

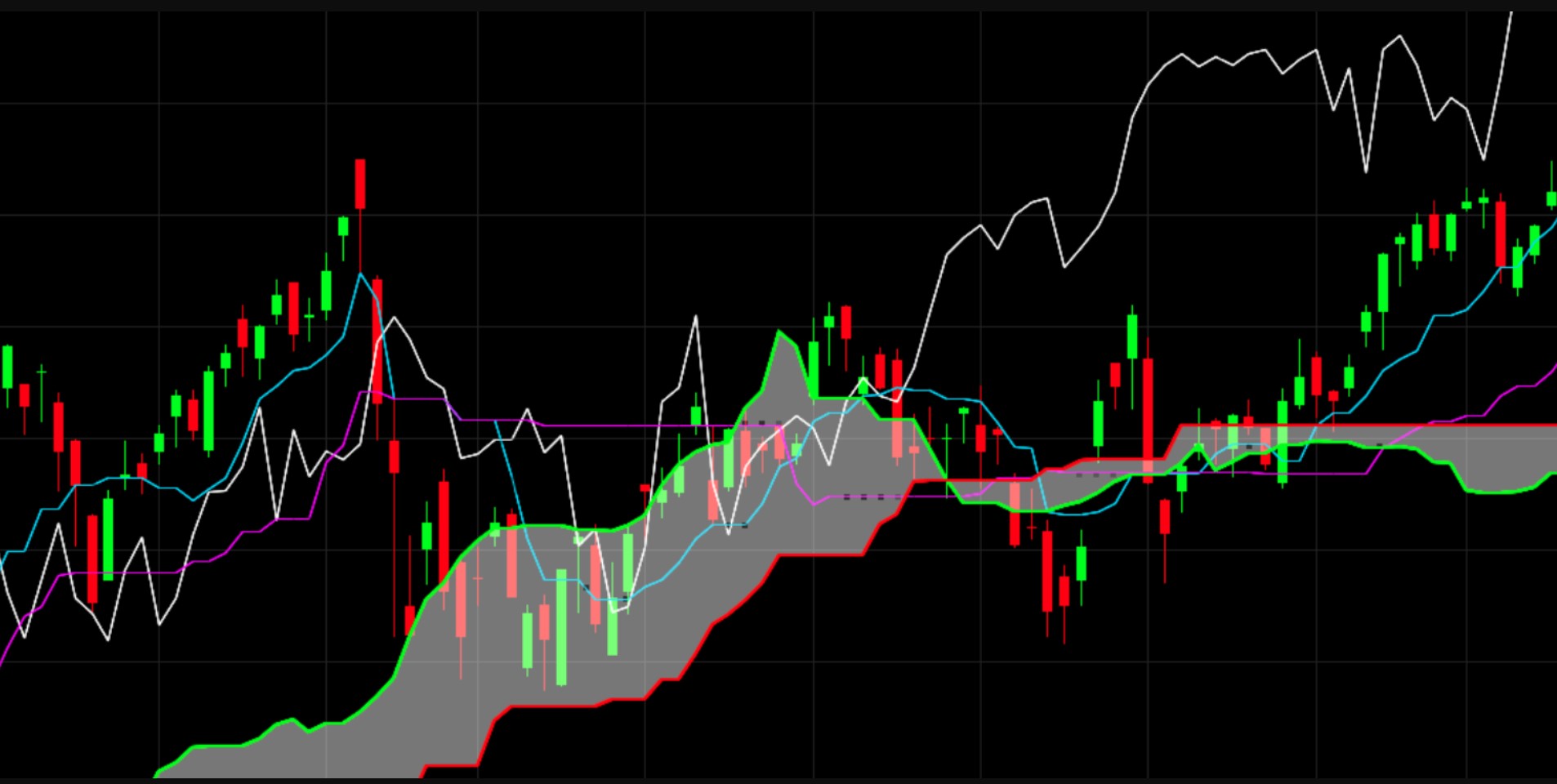

The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a comprehensive technical analysis tool developed by Japanese journalist Goichi Hosoda in the late 1930s. It provides traders with valuable insights into market trends, support and resistance levels, and potential entry and exit points. The indicator’s name translates to “one glance equilibrium chart,” highlighting its ability to offer a holistic view of the market at a glance.

Realization the Components of Ichimoku Cloud

The Ichimoku Cloud comprises five key components, each providing distinct information to traders:

1. Tenkan-Sen (Conversion Line)

The Tenkan-Sen, often referred to as the Conversion Line, is calculated by averaging the highest high and lowest low over a specific period, usually nine periods. It offers insights into short-term price momentum and helps identify potential trend reversals.

2. Kijun-Sen (Base Line)

The Kijun-Sen, or the Base Line, is calculated similarly to the Tenkan-Sen, but over a more extended period, typically 26 periods. It provides a medium-term perspective of price movements and helps traders gauge the overall market trend.

3. Senkou Span A (Leading Span A)

Senkou Span A, or Leading Span A, represents the average of the Tenkan-Sen and Kijun-Sen. It is plotted ahead of the current price and acts as the first part of the cloud, also known as the “Kumo.” This component helps identify potential areas of support and resistance.

4. Senkou Span B (Leading Span B)

Senkou Span B, or Leading Span B, is calculated based on the highest high and lowest low over an extended period, typically 52 periods. Like Senkou Span A, it is plotted ahead of the current price and forms the second part of the Kumo. The area between Senkou Span A and Senkou Span B represents the cloud, providing valuable insights into potential future price movements.

5. Kumo (Cloud)

The Kumo, formed by the area between Senkou Span A and Senkou Span B, represents a dynamic support and resistance zone. Its thickness indicates the overall market volatility, and traders often use it to identify potential breakout and reversal points.

Trading Strategies with Ichimoku Cloud

Now that we understand the components of Ichimoku Cloud, let’s explore some effective trading strategies that incorporate this powerful tool:

The Trend-following Strategy

The trend-following strategy is one of the most popular approaches among Ichimoku Cloud traders. It involves focusing on the position of the price concerning the Kumo. When the price is above the Kumo, it indicates a bullish trend, and traders may consider long positions. Conversely, when the price is below the Kumo, a bearish trend is indicated, and short positions might be appropriate.

The Kumo Breakout Strategy

The Kumo Breakout Strategy is a popular trading approach that leverages the dynamic support and resistance levels provided by the Ichimoku Cloud’s Kumo. This strategy focuses on identifying potential trend reversals and breakouts to enter new positions at the early stages of a new trend.

How the Kumo Breakout Strategy Works:

- Understanding the Kumo:

- The Kumo, also known as the cloud, is formed by the area between Senkou Span A and Senkou Span B of the Ichimoku Cloud.

- It acts as a dynamic support and resistance zone and helps traders identify potential price movements.

- Identifying a Potential Breakout:

- Traders look for the price to break above or below the Kumo to identify potential trend reversals or breakouts.

- A bullish breakout occurs when the price breaks above the Kumo, indicating a possible upward trend.

- A bearish breakout occurs when the price breaks below the Kumo, suggesting a potential downward trend.

- Confirming the Breakout:

- To increase the accuracy of the breakout signal, traders often look for confirmation from other indicators or timeframes.

- They may use candlestick patterns, momentum indicators, or trendlines to validate the breakout signal.

- Entry and Stop-Loss Placement:

- After confirming the breakout, traders enter a position in the direction of the breakout.

- For a bullish breakout, a long position is considered, while for a bearish breakout, a short position is taken.

- Stop-loss orders are placed below the Kumo for bullish breakouts and above the Kumo for bearish breakouts to limit potential losses.

- Managing the Trade:

- Once the trade is active, traders monitor the price movement and adjust their stop-loss levels if necessary.

- They may also use trailing stop-loss orders to protect profits and let the trade run in the direction of the trend.

- Profit Target:

- The profit target is set based on the trader’s risk-reward ratio and the potential price movement after the breakout.

- Some traders use technical analysis tools, such as Fibonacci extensions or previous price highs or lows, to determine their profit target.

Advantages of the Kumo Breakout Strategy:

- Early Entry into Trends: The Kumo Breakout Strategy allows traders to enter new positions at the early stages of a trend, potentially maximizing profits.

- Clear Entry and Exit Signals: The breakout above or below the Kumo provides clear and objective entry and exit signals, making the strategy straightforward to implement.

- Dynamic Support and Resistance: The Kumo acts as a dynamic support and resistance zone, providing valuable insights into potential price movements.

Considerations and Risks:

- False Breakouts: Like any breakout strategy, false breakouts can occur, leading to potential losses. Traders should use confirmation tools to reduce the risk of false signals.

- Market Conditions: The effectiveness of the Kumo Breakout Strategy may vary depending on market conditions. It is essential to adapt the strategy to different market environments.

- Risk Management: As with any trading strategy, proper risk management is crucial. Traders should not risk more than a certain percentage of their trading capital on a single trade.

The Senkou Span Cross Strategy

The Senkou Span Cross strategy utilizes the crossover of Senkou Span A and Senkou Span B. When Senkou Span A crosses above Senkou Span B, it generates a bullish signal, indicating an upward trend. Conversely, when Senkou Span A crosses below Senkou Span B, a bearish signal is generated, indicating a downward trend. Traders may use this strategy to confirm potential trend reversals.

The Chikou Span Confirmation Strategy

The Chikou Span Confirmation strategy involves using the Chikou Span, or lagging span, to confirm trading signals generated by other components of the Ichimoku Cloud. If the Chikou Span is above the price, it validates a bullish signal, and if it is below the price, it validates a bearish signal. This strategy helps traders filter out false signals and make more informed trading decisions.